Essential strategies for retail distribution managers

Walk into any major retailer, and the products on shelves look effortlessly available. Behind that seamless experience lies a logistics strategy many retailers have adopted to stay competitive: cross-docking for rapid store replenishment.

While traditional retail distribution routes products through regional distribution centers where they sit for weeks, cross-docking moves merchandise from supplier or import container directly to store-bound trucks—often within 24 hours. This speed advantage translates directly into better in-stock rates, reduced markdowns, and improved cash flow.

This guide reveals exactly how retail cross-docking works, which product categories benefit most, and how to implement it successfully for your retail operations.

Why Retail Cross-Docking Matters Now More Than Ever

The Retail Reality: Speed Wins

Today’s retail environment demands:

- Faster trend response: Fashion cycles measured in weeks, not seasons

- Promotional agility: Ability to capitalize on viral moments or competitive opportunities

- Omnichannel fulfillment: Stores serving as forward inventory for online orders

- Reduced markdowns: Getting seasonal goods to shelves earlier extends full-price selling window

Cross-docking delivers on all four requirements by eliminating 7-14 days from the traditional distribution timeline.

The Cost Pressure

Retail margins remain under constant pressure from:

- E-commerce competition forcing price matching

- Rising labor costs (especially in distribution)

- Increasing rent for warehouse space

- Inventory carrying costs consuming working capital

Cross-docking cuts 30-50% from distribution costs while simultaneously improving speed—a rare win-win in retail logistics.

The Customer Expectation

Shoppers now expect:

- Consistent in-stock availability

- Fresh, current merchandise

- Fast restocking after purchasing surges

- Same-day or next-day availability for online orders picking from stores

Cross-docking makes these expectations achievable even with leaner inventory investments.

How Retail Cross-Docking Works

The Traditional Retail Distribution Model

Let’s first understand what cross-docking replaces:

Day 1-3: Merchandise arrives at regional DC, sits in receiving queue

Day 4-7: Product put away into storage racks

Day 8-21: Inventory sits waiting for store orders

Day 22-24: Orders picked, packed for individual stores

Day 25-28: Delivered to stores

Total timeline: 28+ days from DC arrival to store shelf

Touches: 10-15 per unit (receiving, putaway, picking, packing, shipping)

The Cross-Docking Alternative

Hour 1-4: Merchandise arrives at cross-dock facility, immediately unloaded

Hour 5-12: Sorted by store destination, consolidated with other vendor products

Hour 13-18: Loaded onto store-specific outbound trucks

Hour 19-48: Delivered directly to stores

Total timeline: 24-48 hours from facility arrival to store shelf

Touches: 3-5 per unit (receiving, sorting, loading)

Time savings: 26 days faster

Cost savings: 50-70% reduction in handling costs

In-stock improvement: 3-7 days earlier shelf availability

Retail Product Categories Perfect for Cross-Docking

Fast-Moving Consumer Goods (FMCG)

Examples: Beverages, snacks, household cleaners, paper products

Why cross-docking works:

- High predictable demand enables accurate store allocation

- Short shelf life benefits from reduced transit time

- High volume creates consolidation opportunities

- Low per-unit value makes storage costs proportionally expensive

Real-world result: Major grocery chain reduced distribution costs by 38% on beverage category through cross-docking, while improving in-stock rates from 92% to 97%.

Apparel & Fashion

Examples: Seasonal clothing, footwear, accessories

Why cross-docking works:

- Time-sensitive selling windows (seasonal goods lose value quickly)

- Trend-driven demand requires rapid response

- Pre-allocated shipments (vendors ship to specific store sizes/quantities)

- Markdown reduction from faster shelf arrival

Real-world result: Apparel retailer cut 9 days from import-to-shelf timeline, reducing end-of-season markdowns by 15% and improving gross margin by $4.2M annually.

Promotional & Event-Driven Merchandise

Examples: Holiday goods, movie tie-ins, limited editions, promotional items

Why cross-docking works:

- Narrow selling window (must reach stores before event/holiday)

- Pre-planned store allocations (promotional planning done months ahead)

- Delayed arrival means missed sales (can’t sell Halloween items in November)

Real-world result: Retailer using cross-dock for holiday merchandise achieved 22% higher full-price sell-through compared to warehoused seasonal goods that arrived later.

Fresh & Perishable Items

Examples: Produce, dairy, baked goods, flowers, prepared foods

Why cross-docking works:

- Shelf life directly correlates to distribution speed

- Every day saved = more days of sellable product life

- Temperature-controlled chain benefits from minimized handling

- Quality and freshness drive customer satisfaction

Real-world result: Grocery chain extended average produce shelf life by 3.5 days through cross-dock distribution, reducing spoilage by 28%.

Pre-Ticketed Merchandise

Examples: Products arriving from vendors already priced and labeled for specific retailers

Why cross-docking works:

- Floor-ready merchandise needs no DC processing

- Pre-allocated to stores (vendor knows store requirements)

- Any delay only adds cost, not value

- Speed to floor = faster inventory turns

High-Velocity Basics

Examples: White t-shirts, basic denim, standard school supplies, everyday electronics

Why cross-docking works:

- Consistent demand across all stores

- Replenishment formulas well-established

- Storage provides no buffer value (demand is steady)

- High turns mean capital efficiency matters

Real-world result: Electronics retailer cross-docking high-volume accessories (phone cases, chargers) achieved 52 annual inventory turns versus 18 turns on warehoused products.

Setting Up Retail Cross-Dock Operations

Infrastructure Requirements

Facility Design:

- Sufficient inbound and outbound dock doors (minimum 10+ combined)

- Open floor space for sorting (40,000-100,000 sq ft depending on volume)

- Store-specific staging lanes (designated areas for each store’s consolidated shipment)

- Material handling equipment (conveyors, forklifts, pallet jacks)

- Temperature zones if handling perishables

Technology Systems:

- Warehouse management system (WMS) configured for cross-dock flows

- Automated sorting capabilities (barcode scanning, RFID if applicable)

- Real-time inventory visibility

- Store delivery scheduling system

- Carrier coordination platform

- Exception management alerts

Location Considerations:

- Proximity to import gateway (port or airport) for international merchandise

- Central to store network for efficient outbound routing

- Near major transportation corridors (interstate access)

- Available labor market for operations staff

Process Design

Step 1: Advance Shipment Planning

3-5 days before arrival:

- Vendor provides advance ship notice (ASN) with detailed contents

- Retail planners allocate merchandise to specific stores

- Cross-dock facility receives store allocation data

- Outbound trucks scheduled based on delivery windows

Step 2: Inbound Receiving

Upon arrival:

- Scan inbound shipment to verify against ASN

- Immediate quality check for damage or discrepancies

- Product remains on pallets or stays in cases (no depalletizing unless necessary)

- Routed directly to sort area based on pre-assigned store destinations

Step 3: Sorting & Consolidation

Core cross-dock activity:

- Items sorted into store-specific staging lanes

- Products from multiple vendors consolidated into store loads

- Mixed merchandise builds full truckloads per store

- Items remain on pallets or in totes throughout sorting

- Continuous flow (no queue buildup)

Step 4: Outbound Loading

Final stage:

- Store-specific trailers pre-positioned at designated docks

- Consolidated merchandise loaded in reverse store-visit order (first store unloads from back)

- Final scan confirms all items loaded correctly

- Seal trailer and dispatch based on delivery schedule

Step 5: Store Delivery

Completion:

- Deliver during store receiving hours (often early morning)

- Store unloads pre-sorted, floor-ready merchandise

- Minimal store backroom handling required

- Product moves from truck to sales floor within hours

Coordination Requirements

Vendor Management:

- Advance ship notices (ASN) accuracy is critical

- Packaging standards (case-ready, pallet configuration)

- Labeling requirements (store-specific if possible)

- On-time delivery commitments (cross-dock timing is precise)

Store Communication:

- Delivery schedules published weekly

- Advance notification of inbound volume

- Exception handling protocols

- Receiving hour coordination

Carrier Coordination:

- Scheduled outbound pickups (not on-demand)

- Dedicated lanes for consistent stores

- Backup capacity for volume surges

- Real-time tracking requirements

Making the Cross-Dock Decision: A Retail Framework

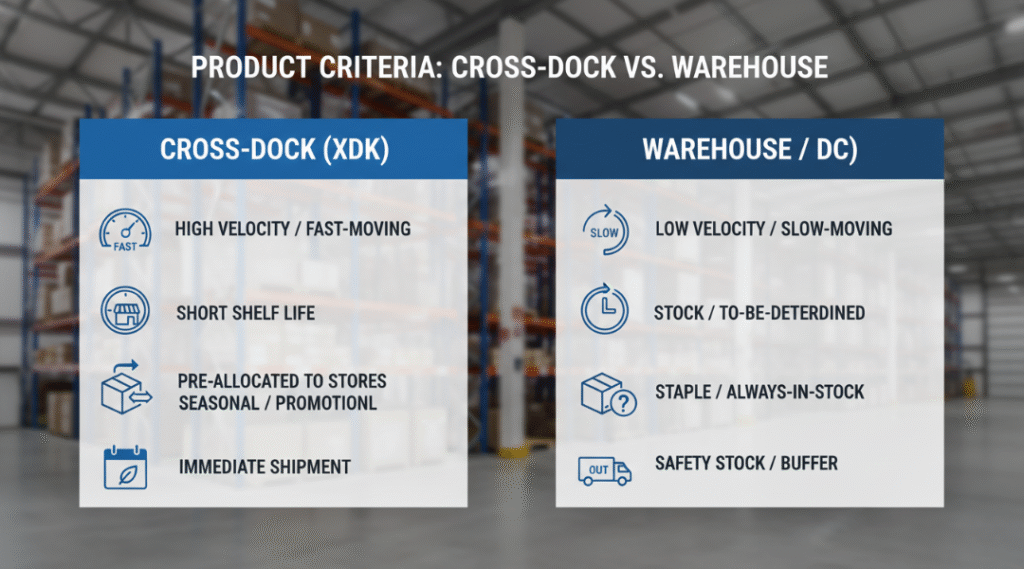

Products to Cross-Dock (Highest Priority)

✓ High-velocity items: Turn >12 times annually

✓ Promotional goods: Limited selling window

✓ Perishables: Shelf life matters

✓ Seasonal merchandise: Value degrades over time

✓ Pre-allocated shipments: Store destinations known in advance

✓ Floor-ready goods: No DC processing needed

✓ Full-case picks: Stores order in full cases

Products to Warehouse (Keep in DC)

✗ Slow-moving items: Low, sporadic demand

✗ E-comm pick-pack: Individual unit picking

✗ Safety stock: Buffer for demand variability

✗ Value-added needs: Kitting, customization, ticketing

✗ Broken-case picks: Stores order individual units

✗ Unallocated inventory: Don’t know destinations yet

The 80/20 Analysis

Reality: Typically 20% of SKUs represent 80% of unit volume

Strategy: Cross-dock the fast 20%, warehouse the long tail

Benefit: Capture most of cross-dock’s cost savings while maintaining flexibility for slower items

Example Segmentation:

- Segment A (20% of SKUs, 80% of units): Cross-dock → 45% cost reduction

- Segment B (30% of SKUs, 15% of units): Hybrid → 25% cost reduction

- Segment C (50% of SKUs, 5% of units): Warehouse → No change

Blended result: 38% overall cost reduction across full assortment

Real-World Retail Cross-Dock Case Studies

Case Study 1: Regional Grocery Chain (85 Stores)

Challenge: Fresh produce arriving from Mexico/California reaching stores 6-8 days after harvest, resulting in 18% spoilage before sale.

Solution: Implemented near-port cross-dock in Los Angeles

- Produce crosses dock within 12 hours of port arrival

- Store-specific loads dispatched same day

- Delivered to stores within 36 hours of harvest

Results:

- Spoilage reduced from 18% to 7% (saving $2.1M annually)

- Average shelf life extended from 4 days to 7 days

- Customer satisfaction scores improved 12 points

- Sales increased 8% (more product available at peak freshness)

ROI: 312% in year one

Case Study 2: Apparel Retailer (240 Stores)

Challenge: Fashion merchandise spending 14-21 days in DC between arrival and store delivery, shortening selling season and increasing markdowns.

Solution: Cross-dock seasonal collections directly from LA port

- Vendor ships pre-allocated by store size and location

- Cross-dock sorts and consolidates within 24 hours

- Stores receive merchandise 16 days faster on average

Results:

- Full-price selling period extended by 2+ weeks

- Markdowns reduced from 32% to 24% of seasonal goods

- Gross margin improvement: $6.4M annually

- Inventory turns improved from 5.8x to 8.2x

- Working capital reduced by $4.2M

ROI: 428% in year one

Case Study 3: Big-Box Retailer (180 Stores, Focus on Promotional Events)

Challenge: Black Friday merchandise arriving too late at some stores, creating uneven inventory distribution and missed sales.

Solution: Cross-dock all promotional/event merchandise

- Event inventory arrives at cross-dock 4 weeks before event

- Brief staging (2-3 days) for consolidation

- Synchronized delivery to all stores 1 week before event

- All stores receive full planned inventory on time

Results:

- Zero stockouts on featured promotional items (previously 15% of stores experienced stockouts)

- Sales increased $8.2M during promotional events

- Customer satisfaction up 18 points during events

- Reduced emergency freight costs by $420K (no more rush orders to stock-out stores)

ROI: 567% (single holiday season)

Case Study 4: Convenience Store Chain (340 Stores)

Challenge: High delivery frequency (3x weekly) with small store volumes creating expensive LTL shipping costs.

Solution: Consolidation cross-dock for multi-vendor shipments

- Vendors deliver to single cross-dock facility

- Products consolidated into store-specific loads

- Full trucks serve clusters of 8-12 stores per route

Results:

- Transportation costs reduced 34% ($1.8M annually)

- Delivery frequency maintained (still 3x weekly)

- Receiving labor reduced 40% at store level (one truck vs. multiple LTL deliveries)

- Product freshness improved (fewer handoffs)

ROI: 246% in year one

Common Implementation Challenges (And Solutions)

Challenge 1: Vendor Compliance

Problem: Vendors not providing accurate ASNs or delivering late disrupts cross-dock timing.

Solution:

- Establish clear vendor requirements and penalties

- Implement vendor scorecarding (track ASN accuracy, on-time delivery)

- Provide incentives for top-performing vendors

- Drop non-compliant vendors from cross-dock program (route through DC instead)

Best practice: Require 95% ASN accuracy and 90% on-time delivery minimum for cross-dock participation.

Challenge 2: Store Receiving Constraints

Problem: Stores can only receive during limited hours (e.g., 6am-10am), creating delivery scheduling bottlenecks.

Solution:

- Cluster stores by region with same delivery day

- Use rolling delivery schedules (Monday stores, Tuesday stores, etc.)

- Negotiate expanded receiving windows for high-volume periods

- Consider drop trailers at large stores (deliver early, store unloads when ready)

Challenge 3: Demand Changes After Shipment En Route

Problem: Store needs change after merchandise is already allocated and sorted.

Solution:

- Brief staging buffer (24-48 hours) allows some flexibility

- Emergency reallocation process for critical situations

- Store transfer process (ship to nearest store, transfer later if needed)

- Accept some inefficiency for flexibility (90% optimization is good enough)

Challenge 4: Volume Variability

Problem: Seasonal peaks and valleys make staffing and capacity planning difficult.

Solution:

- Partner with 3PL offering scalable capacity

- Cross-train staff for multiple roles

- Use temporary labor during peaks

- Implement dynamic scheduling (more/fewer doors active based on volume)

Challenge 5: Technology Integration

Problem: Connecting vendor systems, cross-dock WMS, and store systems requires complex integration.

Solution:

- Use EDI standards (ASN 856, PO 850, etc.)

- Implement integration platform (middleware)

- Start with manual data entry for pilot, automate once proven

- Choose 3PL with experience integrating with retail systems

Measuring Cross-Dock Performance

Key Performance Indicators (KPIs)

Speed Metrics:

- Dock-to-dock time (target: <24 hours)

- Inbound receipt-to-sort time (target: <4 hours)

- Sort-to-load time (target: <8 hours)

- Facility-to-store delivery time (target: <48 hours)

Accuracy Metrics:

- Sorting accuracy rate (target: >99.5%)

- Shipment completeness (target: >99%)

- Store allocation accuracy (target: >98%)

- Damage rate (target: <0.5%)

Cost Metrics:

- Cost per unit processed (track trend)

- Labor hours per 1,000 units (target: 50% of warehouse)

- Transportation cost per store delivery

- Total distribution cost as % of COGS (target: 30-50% reduction)

Service Metrics:

- On-time delivery to stores (target: >95%)

- Store in-stock rate (target: improvement over DC model)

- Store receiving satisfaction score

- Vendor ASN accuracy rate

Financial Metrics

Track these monthly:

- Distribution cost savings vs. DC model

- Markdown reduction from faster delivery

- Inventory carrying cost reduction

- Sales improvement from better in-stock rates

- Overall ROI

Technology Enablers for Retail Cross-Docking

Warehouse Management System (WMS)

Must-have capabilities:

- Cross-dock flow configuration (bypass putaway)

- Wave planning for store consolidation

- Real-time inventory visibility

- Mobile devices for receiving/sorting/loading

- Integration with transportation management

Preferred vendors: Manhattan Associates, Blue Yonder, SAP Extended Warehouse Management

Transportation Management System (TMS)

Key features:

- Store delivery scheduling

- Route optimization

- Carrier selection and tendering

- Real-time shipment tracking

- Proof of delivery capture

Integration: Must connect with WMS for seamless load-to-truck handoff

Visibility Platform

Provides:

- Real-time location of all shipments

- Exception alerts (delays, shortages)

- Predictive ETAs for stores

- Dashboard reporting

- Mobile app for store managers

Automation Opportunities

Consider for high-volume operations:

- Automated sortation systems (tilt-tray, cross-belt)

- Conveyor systems connecting receiving and shipping

- RFID for hands-free scanning

- Automated pallet jacks or AGVs

- Voice-directed workflows

ROI threshold: Usually requires 50,000+ units daily to justify automation investment

Partnering with a Cross-Dock Provider

Build vs. Buy Decision

Build your own cross-dock if:

- Very high volume (500,000+ units weekly)

- Unique requirements not served by 3PLs

- Want complete control

- Have capital to invest

- Can attract/retain operations talent

Partner with 3PL if:

- Moderate volume (<500,000 units weekly)

- Want to test before major investment

- Need flexibility to scale up/down

- Prefer OpEx vs. CapEx model

- Want to leverage provider expertise

Reality: 70% of retailers use 3PL for cross-docking

Selecting a Cross-Dock Partner

Evaluation criteria:

Location:

- Proximity to import gateway (port/airport)

- Central to store network

- Highway access for outbound routing

Capabilities:

- Sufficient dock doors (20+ for retail volumes)

- Proven retail experience

- Store delivery network

- Technology systems

- Scalable capacity

Service:

- Dedicated account management

- Flexible to accommodate changes

- Proactive communication

- Problem-solving orientation

Financial:

- Transparent pricing

- Competitive rates

- Flexible contract terms

- Strong financial stability

References:

- Similar retail clients

- Positive testimonials

- Proven performance metrics

Southern California: Ideal for Retail Cross-Docking

Why LA is Perfect for Retail Distribution

Import gateway: 40%+ of U.S. containerized imports through LA/Long Beach ports

Market access: Serves the West’s 75 million consumers within 1-2 day delivery

Infrastructure: Extensive highway network, rail connections, airport capacity

Labor: Deep pool of experienced logistics workers

Climate: Year-round operations (no weather disruptions)

The Near-Port Cross-Dock Advantage

For retailers importing through Los Angeles:

Speed: Containers cross-dock within 24 hours of port arrival

Cost: Minimal drayage from port to cross-dock facility

Efficiency: Immediate distribution to western stores without intermediate warehousing

Example flow:

- Container arrives at LA port Monday morning

- Picked up by cross-dock provider Monday afternoon

- Sorted and loaded onto store trucks Tuesday morning

- Delivered to California/Arizona/Nevada stores Wednesday-Thursday

- On store shelves by Friday

Total time: 4 days from port arrival to shelf (vs. 21+ days through traditional DC)

Getting Started: Your 90-Day Implementation Plan

Month 1: Assessment & Planning

Week 1-2: Analyze current state

- Calculate current distribution costs

- Map product flow and timeline

- Identify pain points

- Segment products by cross-dock fit

Week 3-4: Design future state

- Select products for cross-dock pilot

- Choose store subset (20-30 stores)

- Define success metrics

- Develop business case and ROI projection

Month 2: Partner Selection & Setup

Week 5-6: Evaluate providers

- Request proposals from 3-5 cross-dock providers

- Visit facilities

- Check references

- Negotiate agreements

Week 7-8: Process design

- Map detailed workflows

- Establish vendor requirements

- Set up technology integration

- Train team members

Month 3: Pilot Launch & Optimization

Week 9-10: Soft launch

- Start with 1-2 vendors

- Serve 10-20 pilot stores

- Monitor closely

- Address issues immediately

Week 11-12: Expand & optimize

- Add vendors and stores gradually

- Refine processes based on learning

- Collect performance data

- Calculate actual ROI

Month 4+: Scale & Continuous Improvement

- Expand to full product categories

- Serve all stores

- Optimize consolidation patterns

- Drive cost improvements

- Achieve projected ROI

Partner with Retail Cross-Dock Experts

Retail cross-docking delivers measurable results—faster replenishment, lower costs, better in-stock rates—but requires specialized infrastructure, proven processes, and retail expertise.

Precision Worldwide Logistics: Your LA Retail Distribution Partner

Strategic Location: Minutes from LA/Long Beach ports—the gateway for retail imports

Retail Experience: Decades serving apparel, grocery, consumer goods, and specialty retailers

Integrated Services: Port drayage + cross-dock + store delivery under one roof

Technology Platform: Real-time visibility from container to store shelf

Flexible Capacity: Handle pilot programs or full distribution networks

Proven Results: Clients typically achieve 30-50% cost reduction and 40-60% faster replenishment

Schedule Your Free Retail Distribution Assessment

Let our retail logistics experts analyze your distribution network:

- Current cost and timeline audit

- Cross-dock suitability analysis for your assortment

- Custom ROI projections based on your volumes

- Implementation roadmap and timeline

- Risk assessment and mitigation strategies

Contact Precision Worldwide Logistics:

📞 Call: (800) 937-1599

✉️ Email: [email protected]

🌐 Visit: www.precisioninc.com

Final Thought: The Competitive Imperative

Retail is a speed game. While you’re deciding whether to implement cross-docking, your competitors are already doing it—getting products to shelves faster, reducing markdowns, improving in-stock rates, and capturing sales you’re missing.

Every week of delay costs you:

- Unnecessary distribution costs

- Lost sales from stockouts

- Higher markdowns on seasonal goods

- Slower inventory turns

The retailers winning in today’s environment aren’t necessarily the biggest—they’re the fastest and most efficient.

Start your cross-dock journey today.

Precision Worldwide Logistics – Accelerating Retail Distribution in Southern California Since 1999